SOLD

Tech–3403: Consistently Profitable Imaging Center in the South West

Turnkey, Excellent Facilities, Plenty of Growth Potential

This business is about 17 years old and is part of a very busy physician’s practice. The physician owner has been in practice for over 30 years and wants to divest the imaging center as he wants to slow down. He would like to sell it to someone who can devote his full attention to it and grow it to its full potential. The imaging center occupies about 5,671 sq. ft. of the building that the practice occupies.

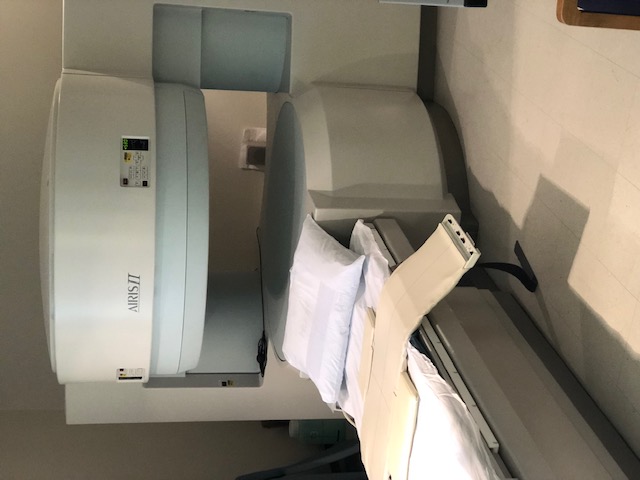

The imaging center is offering multiple modalities with 0.3T Hitachi Airis II open MRI, 16-slice GE Lightspeed CT scanner, Hitachi Hi Vision 6500 6P Ultrasound (bought in 2018), and GE Advantx Digital X-ray. It also has a PACS system for remote access to scans for teleradiology. Although Airis II is an older machine, it is still a very popular open MRI machine and because of its low cost of operation and reliability, there are hundreds of these in service today and will be around for a long time. Servicing and upgrading these with software upgrades is very lucrative business for Hitachi.

SCAN VOLUME

The monthly, average scan volumes in 2019 were as follows:

- MRI: 202 scans per month

- CT: 122 scans per month

- Ultrasound: 135 scans per month

- X-ray: 277 scans per month

FINANCIALS

| Actual | Projected (assumes 10% growth) |

||||

| 2017 | 2018 | 2019 | 2020* | 2021* | |

| Revenue ($ in M) | 1.46 | 1.42 | 1.3 | 1.43 | 1.57 |

| EBITDA $ in 100s | 318 | 393 | 284 | 312 | 343 |

| EBITDA Margin | 21.8% | 27.7% | 21.8% | 21.8% | 21.8% |

| Weighted Adjusted EBITDA (2017-2019): $326K Discretionary Earnings for a Radiologist buyer $526K (keeps $200K radiologist salary) |

|||||

| For 2020, adjusted by ignoring and adjusting March-June due to Pandemic | |||||

In 2019, the revenues of the Center were $1.3M and weighted average EBITDA was $326K. The center does not have any debt and hence comes debt free. Significant volume is generated internally and rest of it is generated primarily through word of mouth as there is no dedicated salesperson, a solid marketing plan, or even a website. So, there is significant growth potential for a growth-oriented buyer. The seller feels that with the proper marketing, it is very possible to grow the revenue and EBITDA by 30-40% over next 3-4 years. The growth rate could be further increased by investing a high-field open MRI at some point in the future. The table above shows the actual revenue and EBITDA of past three years, and projected revenue over next two years with assumed yearly growth of about 10% for the next 2 years while assuming the same EBITDA margin as in 2019. This of course is subject to the buyer’s interest and efforts in growing the business. The 2020 revenue may have to be adjusted slightly by ignoring months of March-May due to the Corona pandemic, when many of the referring physician practices were shut down.

EMPLOYEES

The Center employs 6 full time and 4 part-time people. Currently, a person from the practice is managing the Center, but there are capable people within the Center who can take over as manager of the Center.

INSURANCES

The center accepts all major insurances. The biggest volume of scans are from patients who have Medicare (24.1%), Aetna (15.9%), and BCBS (14.6%). The Center has seen stable revenues and solid profits over the years. About 40% of MRI volume and about 25% of CT volume comes from internal referrals. He is therefore selling the imaging center part of the business. The accounts pertaining to the practice and the imaging has been kept cleanly separated and so it is easy to separate out the revenue, expenses, and other financials of the imaging center.

KEY ADVANTAGES

- Business with Consistent Profits

- High Growth Potential

- Multi-Modal

- Debt-free

- Substantial Internal Built-in Volume

- Excellent Location

- Plenty of Space to Expand and Bring in New Modality

ASKING PRICE

The business is offered debt-free at $1.25M, at a very reasonable multiple of EBITDA. Investment Grade Real Estate is also available separately for $3.4 million with 7.1% CAP. Property includes about 12.5 acre of land in 18,500 sq. foot medical and professional building with multiple tenants across from a hospital.